You've probably heard of Pendo. It's the go-to product analytics and in-app guidance platform for enterprise teams. Strong analytics, automatic event tracking, solid session replays. But getting a price from them? That takes weeks of sales calls, demo after demo, and "let me check with my manager" on repeat.

This pricing opacity benefits Pendo's negotiators, not you. Teams who walk in knowing the numbers pay 40% less than those who don't. Without benchmarks, you're guessing and likely overpaying.

In this article, we'll break down Pendo's four tiers, what each includes, real customer pricing data, and negotiation tactics that work. We'll also compare Pendo against alternatives so you can choose the best fit for your stage.

Plans Overview

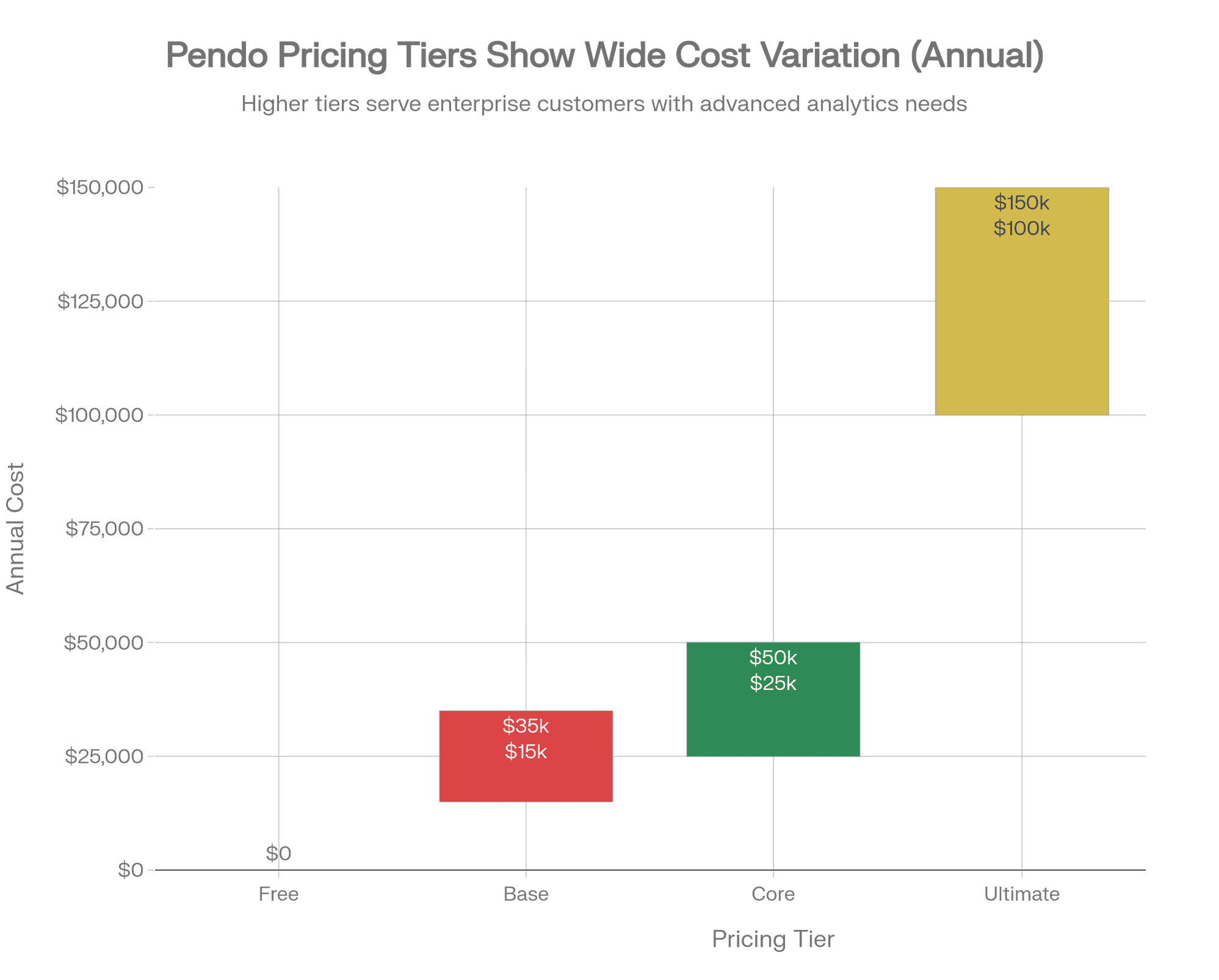

Pendo structures pricing around Monthly Active Users (MAUs). Your cost scales with unique users touching your product each month, not seats or pageviews. Four tiers exist: Free, Base, Core, and Ultimate.

Based on Vendr data and customer forums, Pendo contracts typically land between $15,000 and $142,476 annually. Average mid-market deals sit around $47,330/year.

| Feature | Free | Base | Core | Ultimate |

|---|---|---|---|---|

| MAUs | 500 | Custom | Custom | Custom |

| Annual Price | $0 | $15,900–$35K | $25K–$50K+ | $100K+ |

| Product Analytics | Basic | Full | Full + Replays | Full + Replays |

| In-App Guides | Advanced + AI | |||

| Session Replays | ||||

| NPS Surveys | Branded | Add-on | Add-on | Unbranded |

| Integrations | 1 only | Multiple | 70+ Native | |

| Product Engagement Score | ||||

| Data Explorer | ||||

| Journey Orchestration | ||||

| White-Label | ||||

| Support | Self-serve | Email/Chat | Chat | Dedicated |

Free

Pendo Free gives you automatic event tracking, basic guides, branded NPS surveys, and dashboards for $0. You can create roadmaps, segment users, and run retention reports without writing code.

The 500-MAU ceiling creates problems fast. Once you cross it, guide creation locks. Survey creation locks. Segment creation locks. Your reports start sampling randomly from 500 users instead of showing complete data.

Teams outgrow Free within 2-4 months of production use. The moment you need CRM integration or unbranded surveys, Pendo routes you into paid contracts.

Base ($15,900–$35K/year)

Pendo Base covers 2,000–5,000 MAUs. You get full product analytics and in-app guides. The constraint: one integration only. Pick Salesforce or Slack, not both.

Real contract data from customers:

- $660/month for 2,000 MAUs (~$8K–$10K/year with annual discount)

- $2,000/quarter for 2,000 MAUs

- $30,000/year for webhook access

No session replays. No white-labeled NPS. Product Engagement Score and Data Explorer require Core or higher.

Core ($25K–$50K/year)

Pendo Core covers 5,000–15,000 MAUs. This tier unlocks session replays, Product Engagement Score, Data Explorer for custom queries, and multiple integrations.

"Session replays cut our support tickets by 18%. We spotted friction in our onboarding flow that surveys never revealed." - Growth PM at a Series B SaaS

NPS surveys still carry Pendo branding unless you pay extra. Pendo Listen requires an add-on purchase even at this tier.

Ultimate ($100K+/year)

Pendo Ultimate covers 50,000+ MAUs. Everything from Core plus: custom CSS/JavaScript for guides, real-time sync with Snowflake and Redshift, unlimited native integrations, SOC 2 Type 2 compliance, dedicated CSM with 24/7 support, journey orchestration, and white-labeled NPS.

One customer reported $120,000 annually with a mandatory 3-year commitment, totaling $360,000 in contract value.

Forrester's commissioned study claims 94,500 hours recovered annually and 80% support ticket reduction for enterprise implementations. These numbers come from Pendo-funded research. Your mileage will vary.

Pricing Comparison

| Tool | Entry Price | Mid-Market Cost | Analytics | Guides | Session Replays |

|---|---|---|---|---|---|

| Pendo | Free (500 MAU cap) | $40K–$80K/yr | Core+ only | ||

| Userorbit | Free (higher limits) | $3K–$10K/yr | All paid tiers | ||

| Userpilot | $299/mo | $5K–$12K/yr | Limited | ||

| Appcues | $500/mo | $8K–$15K/yr | |||

| WalkMe | Quote-based | $50K–$100K+ | Add-on | ||

| Whatfix | Quote-based | $40K–$80K+ | Add-on |

Pendo's auto-tracking provides retroactive analytics that competitors lack. You can investigate behavior from weeks ago without pre-configured events.

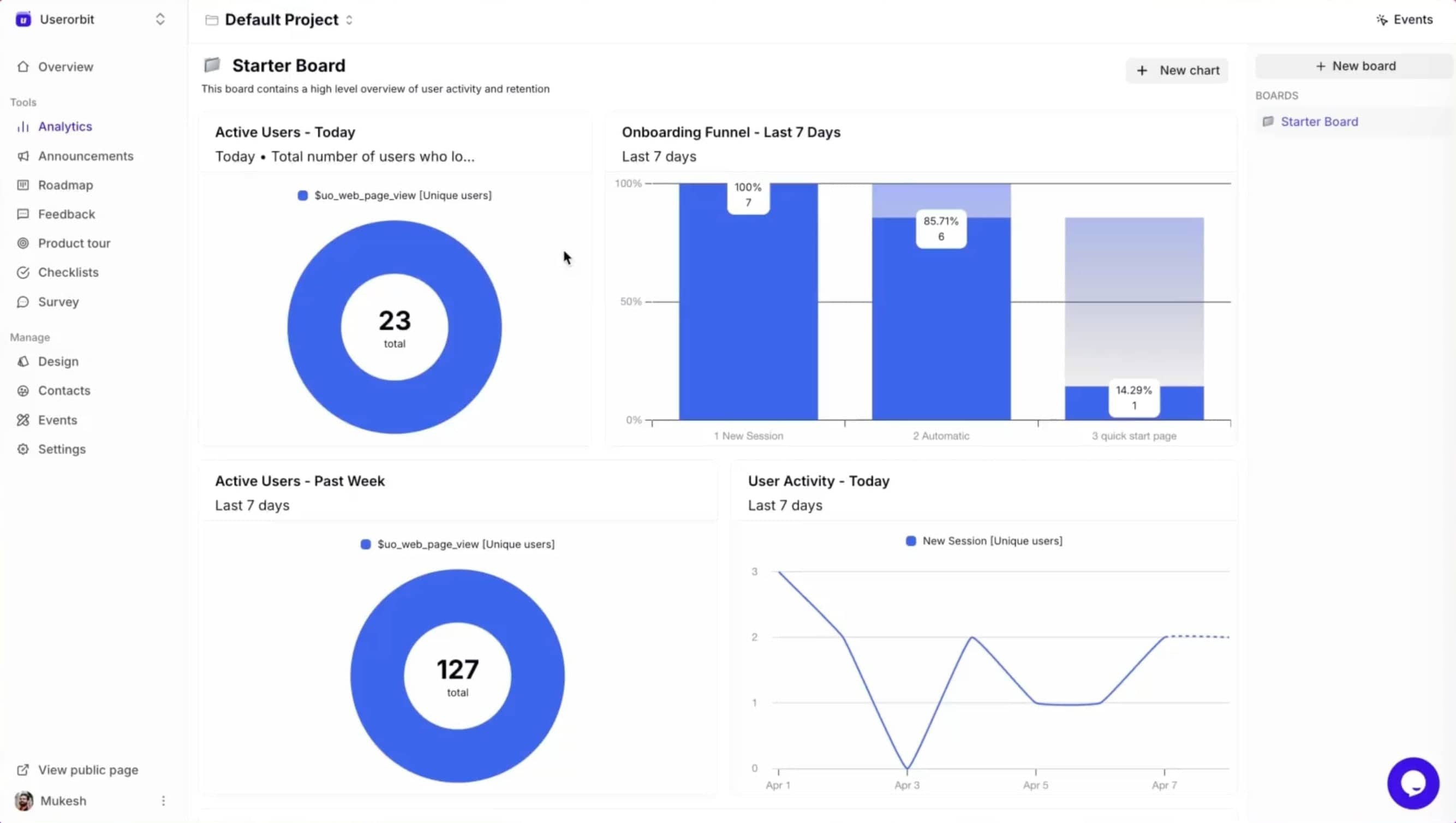

For teams focused primarily on onboarding flows, Userpilot and Appcues offer 3-8x better pricing than Pendo's Base tier. WalkMe and Whatfix compete at similar price points but with different strengths in digital adoption. Userorbit combines Pendo-level analytics depth with transparent pricing—matching auto-tracking and session replay capabilities at a fraction of the cost.

Userorbit product tour builder UI

Get Pendo-level analytics at a fraction of the cost

Auto-tracking, session replays, and in-app guides - no sales calls required.

What You Get

Product Analytics

Pendo tracks interactions automatically: page views, clicks, form submissions, custom events. No manual instrumentation required. You investigate user behavior retroactively, not just from when tracking started.

Strengths: Funnel analysis, path analysis, retention cohorts, Product Engagement Score, session replays (Core+), and custom dashboards. The analytics depth suits teams running complex adoption experiments across multiple product lines. Data Explorer (Core+) enables SQL-like queries for power users.

Limitations: Session replays require Core tier ($25K+/year minimum). Product Engagement Score locked behind Core. Implementation typically takes several days with professional services often needed.

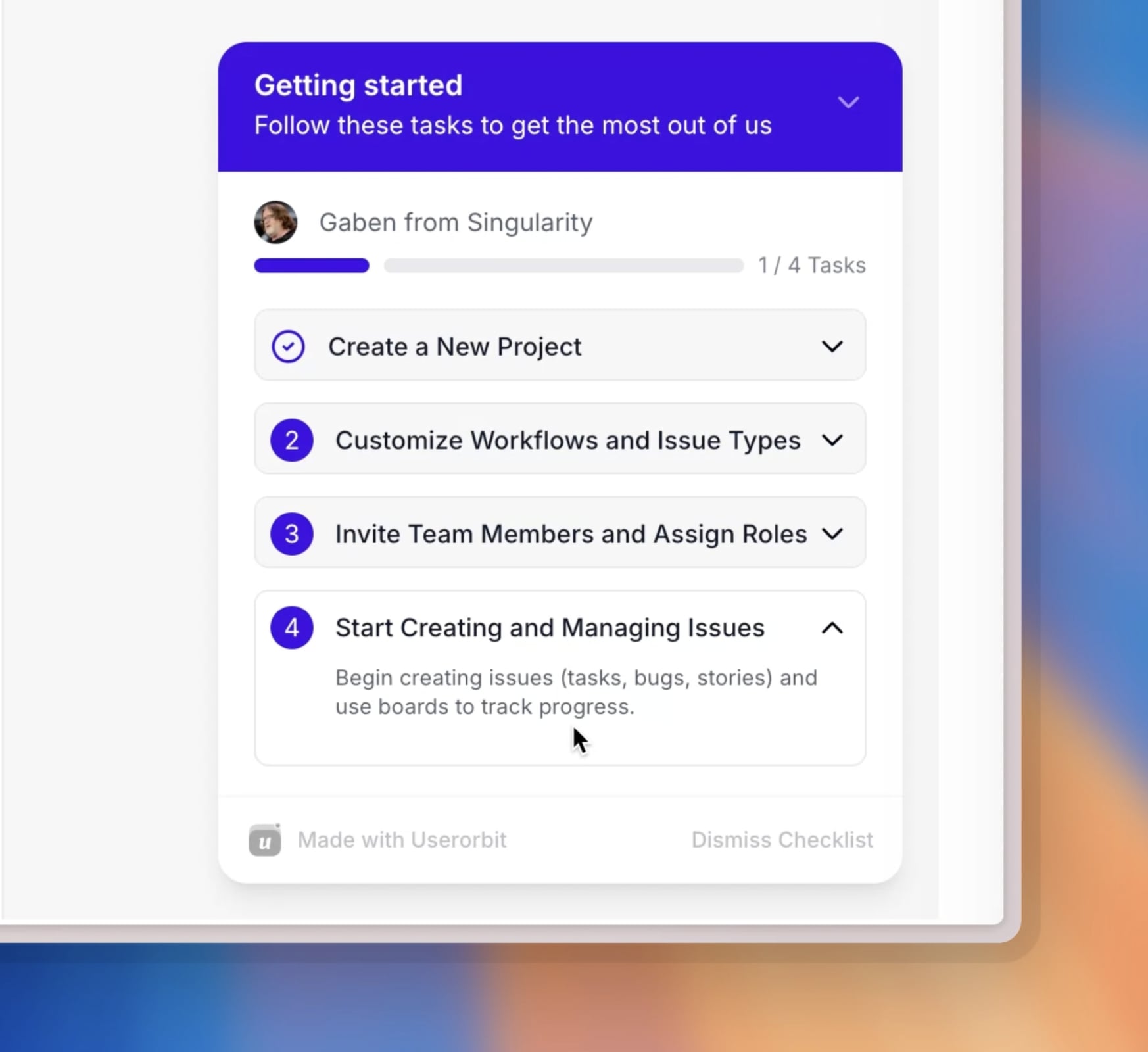

In-App Guides

Pendo's no-code builder deploys walkthroughs, tooltips, hotspots, and banners without engineering involvement. Guides support conditional logic, showing different content to different segments. Teams report 20-40% improvements in feature adoption through well-designed guide sequences.

Strengths: Mature visual editor, strong segmentation options, guide analytics built-in.

Limitations: Custom CSS/JavaScript requires Ultimate tier. Lower tiers restrict customization options significantly. A/B testing capabilities less robust than dedicated experimentation tools.

Surveys and Feedback

Pendo supports NPS, CES, and custom surveys. Pendo Listen automates sentiment analysis for organizations collecting high volumes of responses.

Strengths: In-app survey delivery, response targeting by segment, Pendo Listen AI summarizes themes and tracks sentiment over time.

Limitations: Free and Base tiers get Pendo-branded surveys only. Unbranded surveys require Ultimate. Pendo Listen is an add-on purchase even at Core tier.

Integrations

Pendo connects with 70+ tools: Salesforce, HubSpot, Slack, Zendesk, Segment, Snowflake, Looker, Tableau, Jira, Confluence.

Strengths: Deep enterprise integrations, data warehouse sync (Snowflake, Redshift) at Ultimate tier, native Salesforce and HubSpot connections.

Limitations: Free gets no integrations. Base gets one only. Core gets multiple. Full API access requires Ultimate. This tiered restriction forces upgrades when your tech stack grows.

How to Negotiate

Pendo's pricing appears fixed. It isn't. Multi-year commitments, volume, and timing unlock significant discounts.

Multi-Year Commitments

Annual billing saves 15-20% versus monthly. Multi-year deals unlock 41-46% discounts. A 3-year commitment cuts effective annual cost nearly in half.

One customer negotiated from $1,900 per 1,000 MAUs down to $750, a 60% reduction, by combining account growth projections, quarterly billing, and end-of-month signature timing.

Renewal Rate Locks

Contracts without specified renewal pricing expose you to 5-20% annual increases. Negotiate 3-year pricing with fixed escalation caps, 3% annually maximum.

Feature Bundling

Pendo Listen sells separately but bundles at renewal for 25-50% off. Same applies to white-labeled NPS. Request these during upgrade negotiations rather than as separate purchases.

Quarter-End Timing

November, December, and the final week of any quarter provide leverage. Sales teams negotiate harder when quotas are closing.

Competitive Quotes

Pendo's sales team recognizes their pricing looks steep next to Userpilot ($299/month), Appcues ($500/month), or Userorbit. Sharing competitor quotes moves numbers. One customer cut 35% from their initial offer this way.

Choosing the Right Tier

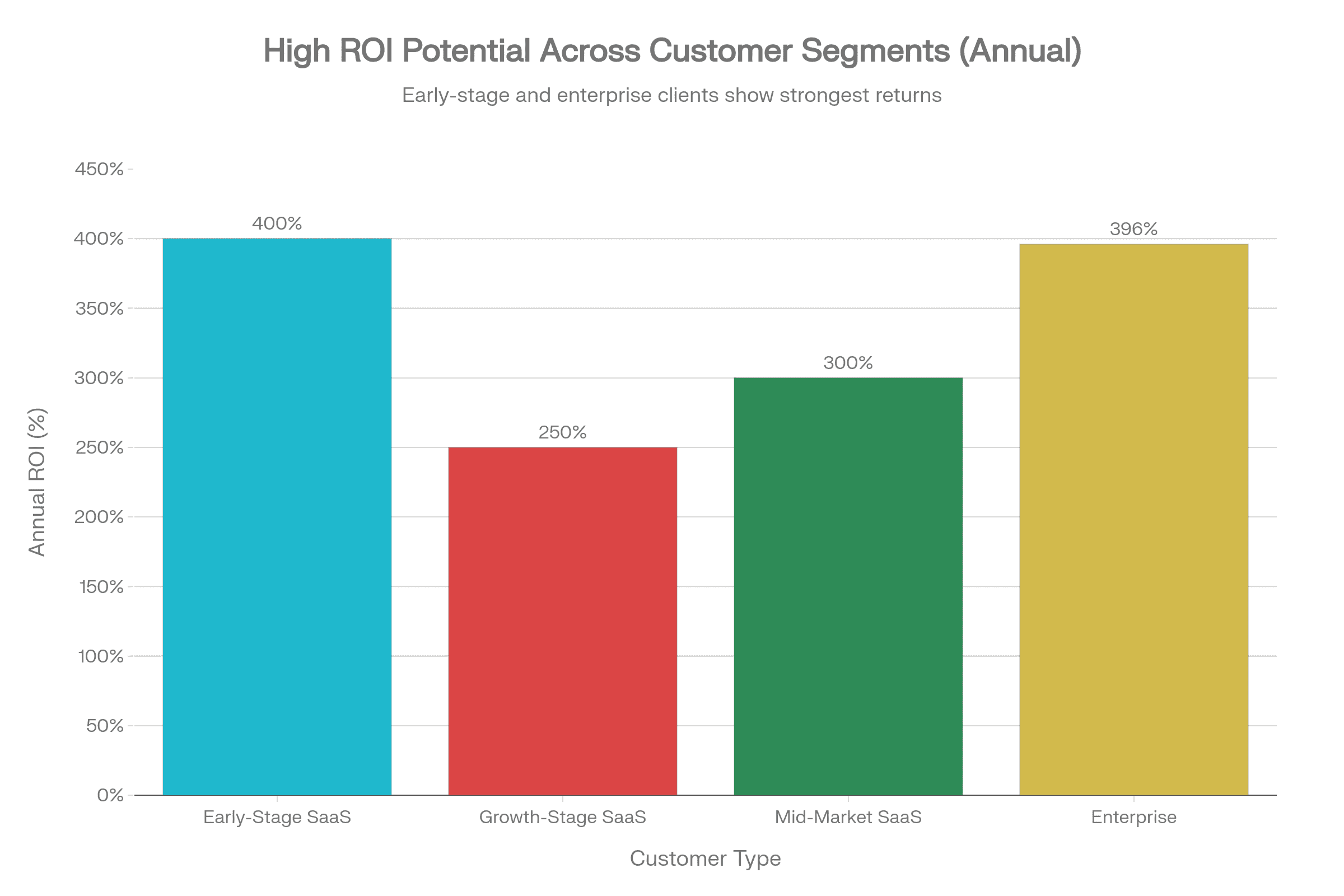

Early-stage (under $5M ARR, under 5,000 MAUs): Pendo Free validates concepts but caps growth quickly. The 500-MAU limit means you'll hit paid tiers within months. Consider whether the vendor lock-in justifies the free tier benefits.

Growth-stage ($10-50M ARR, 5,000-50,000 MAUs): Pendo Core delivers session replays and engagement scoring, but costs $25K-$50K/year. This is where Pendo's value proposition becomes strongest—if you need the analytics depth and can absorb the cost.

Enterprise ($50M+ ARR, 50,000+ MAUs): Pendo Ultimate makes sense for organizations with strict compliance requirements: SOC 2 Type 2, data residency, dedicated support. The 3-year commitment and $100K+ annual cost require executive buy-in but unlock full platform capabilities.

Hidden Costs to Budget

Pendo's sticker price excludes several common expenses:

- Professional services: $5K–$15K for implementation assistance

- Training: 20–40 hours of team time for effective adoption

- Custom integrations: $10K–$30K if you need connections beyond native options

- Add-ons: Pendo Listen, white-labeling, extra MAU capacity

Realistic first-year total for Base tier: $27K (vs. $15,900 list price).

Who Uses Pendo?

Pendo's customer base skews toward mid-market and enterprise SaaS companies. Product teams at companies like Salesforce, Zendesk, and HubSpot use Pendo to track feature adoption and guide users through complex workflows.

FAQ

How do I get a discount on Pendo?

Commit to 2-3 years. Sign near quarter-end. Share competitor quotes. Bundle features at renewal. Discounts of 41-46% are documented.

Is Pendo worth the cost?

For teams prioritizing retroactive analytics with enterprise compliance needs, Pendo Core or Ultimate can justify the spend. The analytics depth, session replays, and Product Engagement Score provide real value for product-led organizations. For teams with tighter budgets, alternatives offer similar capabilities at lower price points.

How long until Pendo pays for itself?

Implementations typically show ROI within 2-6 months. Early-stage companies report 2-month payback periods when measuring reduced support load and improved activation rates.

What's the best Pendo alternative?

Depends on your priorities. For onboarding-focused teams: Userpilot or Appcues. For enterprise digital adoption: WalkMe or Whatfix. For full-featured analytics with transparent pricing: Userorbit. See the comparison table below.

Pendo vs Alternatives

Before making a decision, here's how Pendo stacks up against the main competitors:

| Feature | Pendo | Userpilot | Appcues | WalkMe | Userorbit |

|---|---|---|---|---|---|

| Entry Price | Free (500 MAU) | $299/mo | $500/mo | Quote-based | Free |

| Mid-Market Cost | $40K–$80K/yr | $5K–$12K/yr | $8K–$15K/yr | $50K–$100K+ | $3K–$10K/yr |

| Auto-Tracking | |||||

| Session Replays | Core+ only | Limited | Add-on | All paid tiers | |

| In-App Guides | |||||

| Unbranded Surveys | Ultimate only | ||||

| Sales Process | Required | Optional | Optional | Required | Optional |

| Best For | Enterprise analytics | Onboarding flows | Product tours | Enterprise DAP | Full-featured |

Pendo excels at retroactive analytics and enterprise compliance but comes with quote-based pricing and tier-gated features.

Userpilot and Appcues offer better value for teams focused primarily on onboarding and product tours, with transparent pricing.

WalkMe competes at similar price points to Pendo but focuses more on digital adoption platforms for complex enterprise software.

Userorbit provides comparable analytics depth with transparent pricing and no mandatory sales process.

Summary

Pendo built a strong product analytics platform with automatic tracking, solid session replays, and enterprise-grade compliance. The pricing structure (opaque, negotiation-dependent, tier-gated) creates friction, but for the right use case, it delivers real value.

Pendo is worth it if:

- You need deep retroactive analytics without manual event setup

- Enterprise compliance (SOC 2 Type 2, data residency) is non-negotiable

- You have budget for $25K+ annually and can commit to multi-year contracts

- Your procurement team values Pendo's Fortune 500 track record

Consider alternatives if:

- Budget constraints push you toward <$15K/year solutions

- You primarily need onboarding flows rather than deep analytics

- Transparent, predictable pricing matters more than brand recognition

- You want session replays without upgrading to Core tier

The right choice depends on your stage, budget, and specific feature priorities. Use the negotiation tactics above to get the best Pendo deal, or explore the alternatives that match your needs.

Looking for a Pendo alternative?